Employment Insurance Qualifications Ontario

Register and apply for special benefits if you are self-employed. You are qualified to Employment Insurance EI while you have covered the number of working hours essential for the insurance since the beginning of your last employment Insurance claim or in last fifty-two weeks.

What Happens If Employer Fails To Issue Roe On Time Dutton Employment Law

To apply for Employment Insurance EI benefits you must apply online as soon as you lose your job.

Employment insurance qualifications ontario. Whichever period is shorter as explained earlier. All jobs include performing certain tasks that may be considered requirements. Find a Job Within One Year of Passing the Exam You must be employed by a RIBO registered brokerage before qualifying as a registered insurance broker in Ontario Check out OntarioBrokerJobsca for the latest job postings in Ontario.

Program Characteristics for the period of June 06 2021 to July 10 2021. Be a resident of Ontario. Due to the COVID-19 outbreak we advise you to avoid visiting a Service Canada office and file your application online instead.

A requirement qualification or factor that is neutral and non-discriminatory on its face may nonetheless exclude restrict or prefer some persons because of a ground set out in the Code. Have a disability that is expected to last a year or more and. Workers receive EI benefits only if they have paid premiums in the past year and meet qualifying and entitlement conditions.

When preparing your application you also have to show. Be 16 years of age or older. The number of hours of insurable employment required is determined when you apply for benefits depending on the following.

This decision by the government makes perfect sense says Pinkus. By this same logic if the employee works less than 30 hours a week or less than 130 hours in a month they are considered part-time under the law for the purposes of being offered coverage. You will need to have accumulated between 420 and 700 hours of insurable employment during the qualifying period to be entitled to receive EI regular benefits.

However exception to this is. You will need between 420 and 700 hours of insurable employment based on the unemployment rate in your area during the qualifying period to qualify for regular benefits. Know your rights and obligations under the Employment Standards Act ESA.

The Canada Employment Insurance Commission CEIC plays a leadership role in overseeing the EI. Have a disability that makes it hard for you to find or keep a job. Self-employed workers may participate in EI and receive special benefits.

If youre registered for the self-employed program you need to have made at least 5000 in net earnings in 2020 to be eligible for benefits in 2021 if you received the Canada Emergency Response Benefit CERB the 52-week period to accumulate insured hours will be extended. For more information on eligibility requirements. You have been laid off and are working a temporary job just to cover costs.

Benefits for Canadians living abroad. Violations from previous EI claims may increase the number of hours required to qualify for EI benefits. Your guide to the.

If an employee works at least an average of 30 hours a week or 130 hours a month they are considered full-time and large employers must offer health insurance to them under the law. Your place of residence. Be able to work in Canada.

If you work or live outside of Canada get information on Employment Insurance pensions benefits and taxes. How long you have been unemployed or working your temporary job and looking for work. 1 you must go without work or pay for at least seven consecutive days.

2 you must have worked enough hours during the qualifying period. You dont need to wait to have your Record of Employment letter ROE to start your claim. Eligibility for employment insurance formerly called unemployment insurance has three simple rules.

The office of Employment Minister Carla Qualtrough is also claiming that individuals told to self-isolate by their employers based on guidance from public health officials will also qualify for Employment Insurance without the need of a doctors note. Once you have determined the unemployment rate in your area see the table below for the number of hours required. Apply for benefits if you are a self-employed fisher who is actively seeking work.

A Make sure that job requirements are reasonable and made in good faith. Under the federal Employment Insurance Act 26 weeks of employment insurance benefits called compassionate care benefits may be paid to EI eligible employees who have to be away from work temporarily to provide care to a family member who has a serious medical condition with a significant risk of death within 26 weeks and who requires care or support from one or more family. This guide describes the rules about minimum wage hours of work limits termination of employment public holidays pregnancy and.

To be eligible for Employment Supports you must. If youre receiving Employment Insurance EI or have in the past you can still apply. And 3 you must suffer an interruption of earnings through no fault of your own.

Can You Collect Employment Insurance If You Are Terminated Without Cause

I Lost My Job For Reasons Beyond My Control Can I Get Ei Steps To Justice

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/YS3CBJYGNRG6HKAXTU3UB2DG7E.jpg)

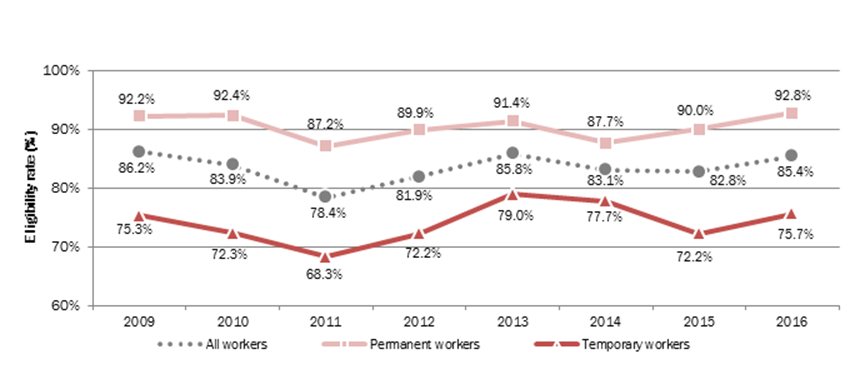

Ei Eligibility Requirements Need To Be Reconsidered With Part Timers In Mind The Globe And Mail

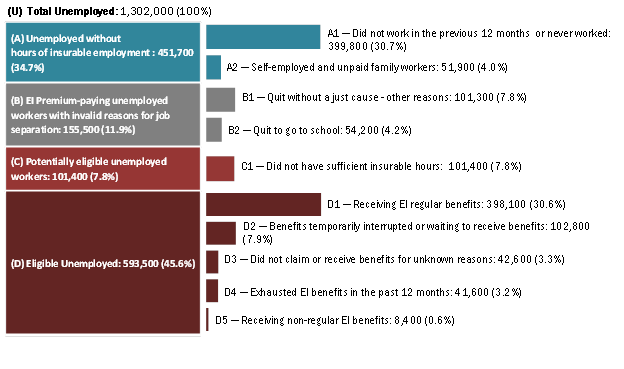

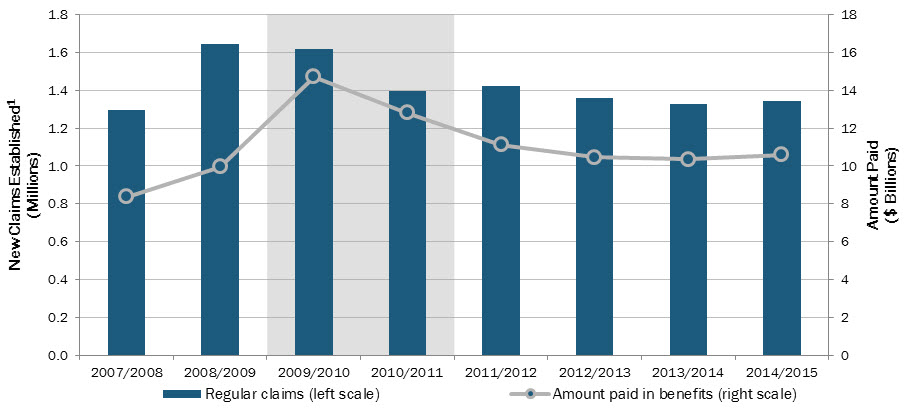

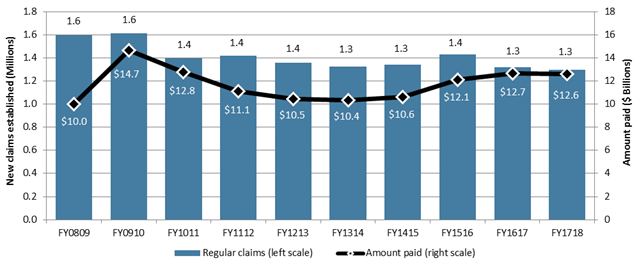

Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2016 And Ending March 31 2017 Chapter Ii 2 Employment Insurance Regular Benefits Canada Ca

Applying For Ei How To Navigate The Application Amid Covid 19 Layoffs Ctv News

Do I Qualify For Employment Insurance If I Am Receiving Severance Samfiru Tumarkin Llp

The Cerb Has Ended Will I Be Able To Get Ei Steps To Justice

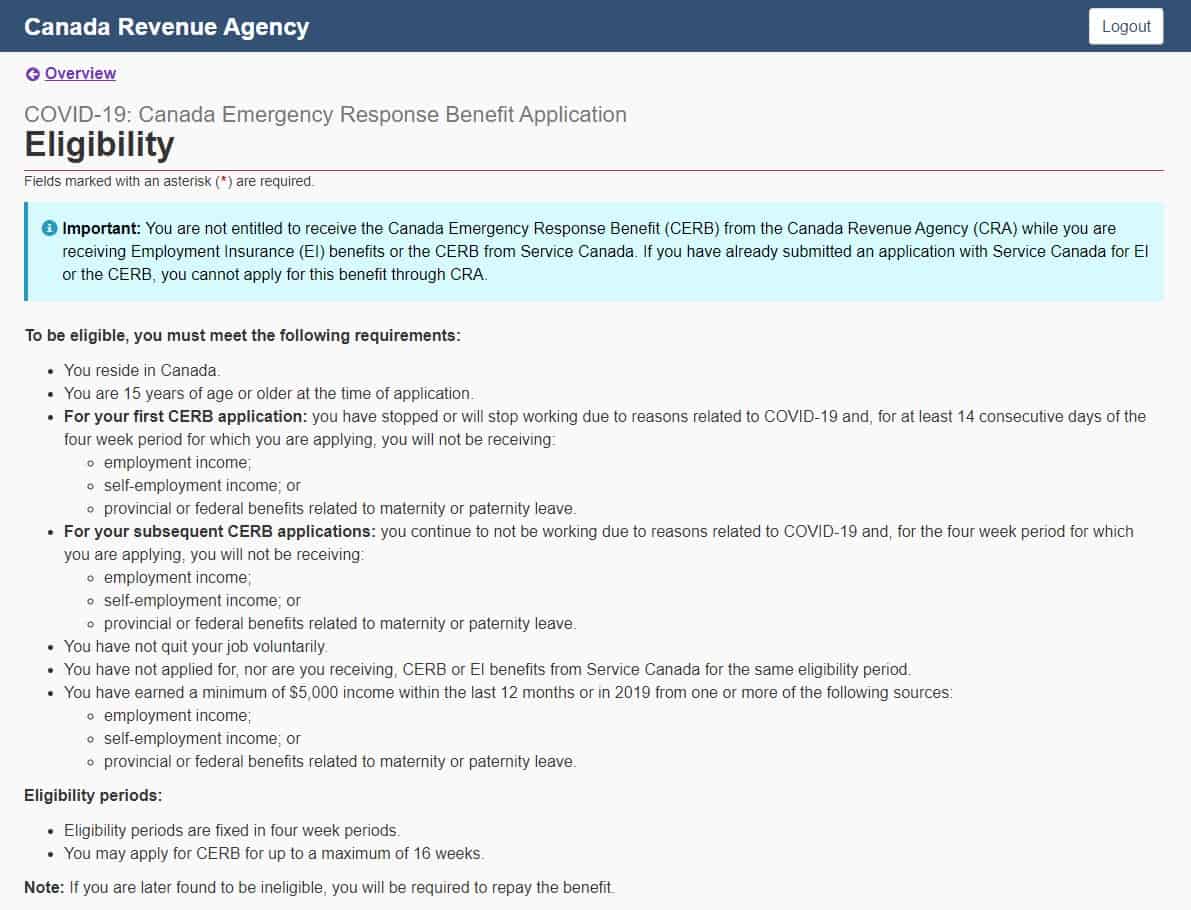

Canada Emergency Response Benefit Cerb For Temporary Foreign Workers And International Students Sps Canada

Terminated For Cause Why You Should Still Apply For Employment Insurance Monkhouse Law

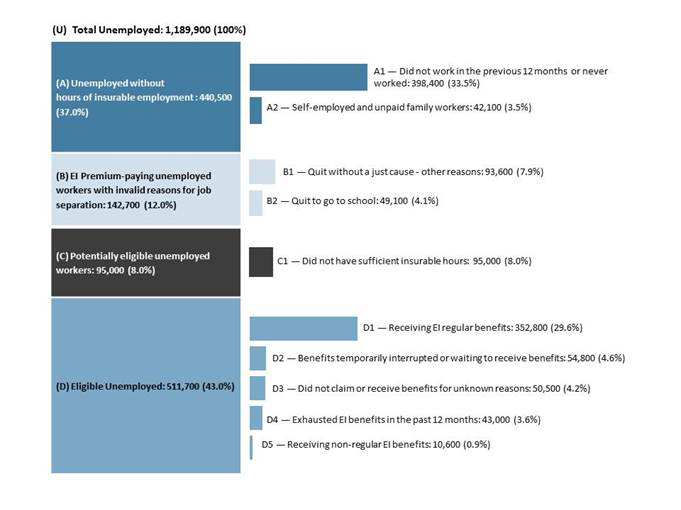

Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2017 And Ending March 31 2018 Chapter 2 2 Employment Insurance Regular Benefits Canada Ca

Employment Insurance Ei Benefits Summary Csalc

Assisting Canadians During Unemployment Canada Ca

Employment Insurance Benefits A Brief Overview Youtube

Here S How Severance Pay Affects Unemployment Benefits

How To Apply For The 2k Month Cerb And Cerb Extension Savvy New Canadians

Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2017 And Ending March 31 2018 Chapter 2 2 Employment Insurance Regular Benefits Canada Ca

Writing Your Certificate Of Qualification Exam Ministry Of Training

Can You Collect Ei When Terminated Without Cause

Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2016 And Ending March 31 2017 Chapter Ii 2 Employment Insurance Regular Benefits Canada Ca

Post a Comment for "Employment Insurance Qualifications Ontario"