How Do I Get A Self Employment Number

Health coverage if youre self-employed. This form can be also be used to register for VAT.

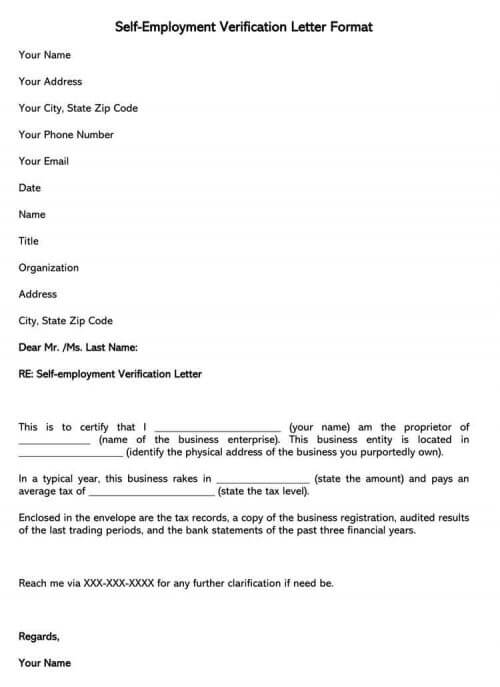

Self Employment Income Verification Letter Sample Examples

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

How do i get a self employment number. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax. Once you have been verified a representative may ask for your social security number.

Before you start the HMRC registration make sure you have your national insurance number handy. Send the tax return and schedules along with your self-employment tax to the IRS. When a lender reviews business income they look at not just the most recent year but a two year period.

They calculate your income by adding it up and dividing by 24 months. You pay tax on net profit by filing an individual income return. If youre self-employed you can use the individual Health Insurance Marketplace to enroll in flexible high-quality health coverage that works well for people who run their own businesses.

You can read more about self-employment paying your Social Security taxes and figuring and reporting your net earnings by reading If You Are Self-Employed. If youre self-employed or a member of a partnership and have been impacted by coronavirus COVID-19 find out if you can use this scheme to claim a grant. You will be required to submit the completed Form SS-4 to obtain a tax ID for self employed individuals.

Even if you dont owe any income tax you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax. HMRCs guidance says the self-employment registration process takes 7 10 days to complete. You may apply for an EIN online if your principal business is located in the United States or US.

To get an up to date estimate of how long your application will take. If youre self-employed you use your individual IRD number to pay tax. Before you submit a tax return for the first time - say after youve started a new business - you need to register for self-assessment which you can do on the HMRC website.

If you received benefits on a prior claim by using a debit card and you no longer have the card or if your card has expired you must call KeyBank at 1-866-295-2955 to get a new card. You can operate your business and file your tax returns under Schedule C the main self-employment tax form using just your Social Security Number SSN. When you do this you will automatically be assigned a UTR number which will be sent in a letter through the post.

Once you have your total number divide it by 6 and youll have your average monthly income for your means test calculation. To set up as a sole trader you must register for income tax with Revenue as a self-employed sole trader. The responsible party is the.

Social Security has been a cornerstone of American security for over 80 years. 2 Your Schedule I On Schedule I youll need to estimate how much - on average - youll earn as a self-employed individual every month going forward. Register for self-assessment online.

Two-Year Self-Employed Average Income. You are limited to one EIN per responsible party per day. Youll receive a letter with your Unique Taxpayer Reference UTR number within 10 days 21 if.

Self-employment includes contracting working as a sole trader and small business owners. You do this using Revenues online service. For example say year one the business income is 80000 and year two 83000.

However there can be delays with this timescales. Youre considered self-employed if you have a business that takes in income but doesnt have any employees. In general anytime the wording self-employment tax.

Usually a self-employed person can start in business without following any formal or legal set up tasks. As a self-employed person your small business is another cornerstone in the foundation of our economy. This is true even if you already get.

Otherwise you do not need to have a federal Employer Identification Number EIN assigned in order to be self-employed. The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. The income used for qualifying purposes is 80000.

The quickest way to get a UTR number is to complete the application form online on the HMRC website but you can also apply by phone see below. Once youve completed the questions HMRC will create your account. A sole proprietor is a self-employed professional who can obtain an Employer Identification Number EIN in the same manner that corporations or LLCs would obtain the same from the IRS.

You can get these forms from the IRS on their website at. Certain people can only register using the tax registration paper form TR1 pdf.

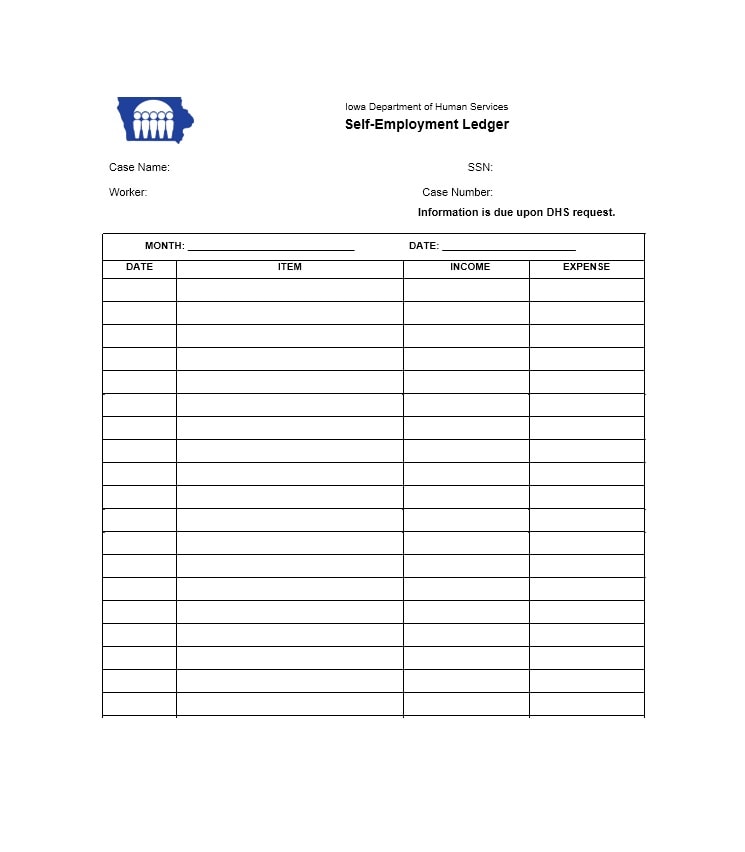

Self Employment Ledger 40 Free Templates Examples In 2021 Self Employment Statement Template Profit And Loss Statement

Self Employment Income Statement Template Fresh Profit And Loss Statement For Self Employed Vrcibtxk Profit And Loss Statement Statement Template Statement

11 Steps To Setting Up As A Sole Trader Self Employed Post 3 Of 10 Sole Trader Business Bank Account Creating A Business Plan

How To Register As Self Employed Uk In 5 Steps Goselfemployed Co Small Business Tax Self Business Checklist

Self Employment In The Uk Daily Infographic Self Employed Jobs Infographic Self Employment

Customizing You To Your Market Resume Examples Resume Writing Sample Resume

Free Self Employment Income Verification Letter Word Example In 2021 Employment Form Self Employment Self

Self Employment Ledger 40 Free Templates Examples

The Self Employed Not Employees But Not Always Business People Either Self Employment Self Business People

Customizing You To Your Market Job Resume Samples Resume Templates Job Resume

Self Employed Invoice Template Pdf Templates Jotform

How To Get A Utr Number From Hmrc Goselfemployed Co Finance Blog Self Business Checklist

The Ultimate Self Employment Starter Kit Self Employment Self Employment

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Small Business Tax Employment

Customizing You To Your Market Fact Sheet Custom Working From Home

Business Expenses And Tax Deductions List Uk For Self Employed Find Out What You Can Small Business Tax Deductions Small Business Tax Business Tax Deductions

Top Self Employment Ideas Business Opportunities From Home Self Employment Self Employment Opportunities Self Employed Jobs

Post a Comment for "How Do I Get A Self Employment Number"